Finding the right insurance plan can save you money and provide peace of mind. When you work with Zdyb Financials Ltd, I strive to provide friendly and professional support for all of your insurance, retirement planning and investment needs.

Financial Planning

Tailored advice to help you achieve your financial goals.

Incorporated Professionals

Tailored solutions to help you with your practice and personal cash flow.

Business Owners

Strategies to help increase your personal cash flow, keep key employees and protect your business.

Individuals & Families

Customized solutions based on you, plans to accumulate and protect your wealth.

Insurance

Peace of mind for you and your family. Taking care of what matters most.

Tailored Investment Planning

Grow your wealth. Feel confident in your finances.

Retirement Planning

Strategies to help you retire with financial confidence.

Estate Planning

Customized strategies for inheritance, wealth transfer and succession to protect your loved ones.

Divorce

Maintain financial security when planning a divorce.

Latest News

Stay Ahead in 2024: A Comprehensive Checklist for Federal Tax Updates

2024 Federal Budget Highlights

Tax tips to know before filing your 2023 income tax

Saskatchewan’s 2024 Budget Highlights

Alberta’s 2024 Budget Highlights

British Columbia’s 2024 Budget Highlights

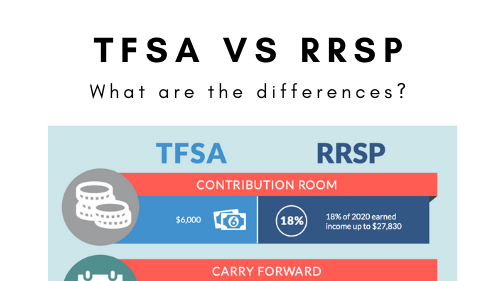

TFSA vs RRSP – 2024

2024 Financial Calendar

2023 Year-End Tax Tips and Strategies for Business Owners

2023 Personal Year-End Tax Tips

Different types of life insurance explained

Don’t lose all your hard-earned money to taxes

Understanding Registered Education Savings Plans (RESPs) in Canada

Understanding Tax-Free Savings Accounts (TFSAs)

Why A Buy-Sell Agreement Is Vital For Your Business

What is Critical Illness Insurance?

First Home Savings Account (FHSA): What You Need to Know

Tax Tips You Need To Know Before Filing Your 2022 Taxes

Federal Budget 2023 Highlights

Saskatchewan 2023 Budget Highlights

Alberta 2023 Budget Highlights

British Columbia 2023 Budget Highlights

TFSA versus RRSP – What you need to know to make the most of them in 2023

2023 Financial Calendar

2022 Year End Tax Tips and Strategies for Business Owners

2022 Personal Year-End Tax Tips

Five Ways To Withdraw Money From Your Business In A Tax-Efficient Manner

Essential tips and tricks for paying less tax and keeping more of your retirement income

Insurance Planning for Incorporated Professionals

Financial Planning For Self-Employed Contractors

The Six Steps to Financial Planning

The Five Steps to Insurance Planning

Why Insurance Is So Important If You’re A Single Parent

The Five Steps to Investment Planning

2022 Federal Budget Highlights

2021 Income Tax Year Tips

Salary vs Dividend

Saskatchewan 2022 Budget Highlights

Life Insurance after 60- is it necessary?

2022 Alberta Budget Highlights

2022 British Columbia Budget Highlights

TFSA versus RRSP – What you need to know to make the most of them in 2022

2022 Financial Calendar

2021 Personal Year-End Tax Tips

2021 Year-End Tax Tips for Business Owners

Why Should I Review My Life Insurance?

“Final Pivot” – COVID-19 Emergency Benefits expire October 23rd, replaced by targeted supports

When should I buy life insurance?

Paying for Education

Estate Planning for Business Owners

Estate Freeze

Group Insurance vs Individual Life Insurance

Accessing Corporate Earnings

British Columbia 2021 Budget Highlights

Federal Budget 2021 Highlights

What’s new for the 2021 tax-filing season?

Importance of a Buy-Sell Agreement

Extended COVID-19 Federal Emergency Benefits

Self-employed: Government of Canada addresses CERB repayments for some ineligible self-employed recipients

TFSA vs RRSP – What you need to know to make the most of them in 2021

2021 Financial Calendar

Government of Canada to allow up to $400 for home office expenses

Business Owners: 2020 Tax Planning Tips for the End of the Year

Highlights of the 2020 Federal Fall Economic Statement | Additional $20,000 CEBA loan available now

Personal Tax Planning Tips – End of 2020 Tax Year

Applications for the new Canada Emergency Rent Subsidy starts today!

Financial Planning

Financial Advice for Business Owners

Why You Should Consider Critical Illness Insurance

Applications for Canada Recovery Benefit now open!

New Canada Emergency Rent Subsidy | Wage Subsidy extended | CEBA additional $20,000 loan

Applications for Canada Recovery Sickness Benefit and Caregiving Benefit starts today!

Investing as a Business Owner

Throne Speech: Recovery Plan Highlights

Saving for Education

CEBA extended to October 31st. Expanded to include more businesses.

Insurance Planning for Business Owners

CERB transitions to NEW Recovery Benefits and EI

Details of the EXPANDED Canada Emergency Wage Subsidy

Retirement Planning for Employees

Canada Emergency Wage Subsidy expanded to include more businesses!

Canada Emergency Wage Subsidy extended into December!

Retirement Planning for Business Owners – Checklist

CERB Extended | Business Owners who did not qualify previously – expanded CEBA starts June 19th

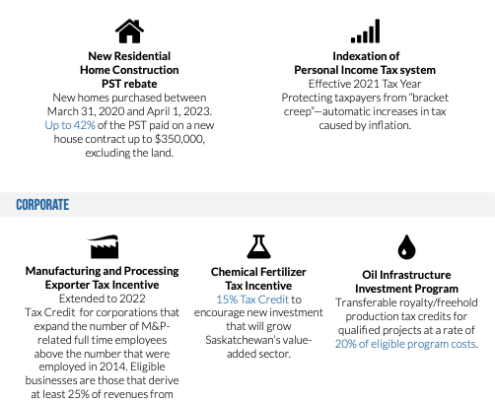

2020 Saskatchewan Budget Highlights

10 Essential Decisions for Business Owners

Small Businesses! Applications for Canada Emergency Commercial Rent Assistance starts May 25th

Expanded eligibility for CEBA $40,000 interest-free loan

Apply starting Friday for Canada Emergency Student Benefit! Help on the way for seniors.

Extended! Canada Emergency Wage Subsidy extended beyond June

Guide to Covid-19: Government Relief Programs in Canada

The Best Way to Buy Mortgage Insurance

75% Commercial Rent Assistance Program

$1,000 BC Emergency Benefit for Workers applications start May 1st

Canada Emergency Student Benefit: Students will be eligible for $1,250 a month from May through August

Apply for Canada Emergency Wage Subsidy starting April 27th | Calculate your subsidy

BC: Reduces commercial property tax for businesses by average of 25%, help local governments

New Canada Emergency Commercial Rent Assistance | Canada Emergency Business Account Expanded

Getting the best from a financial advisor

Expanded eligibility for Canada Emergency Response Benefit (CERB) & Boosted wages for Essential Workers

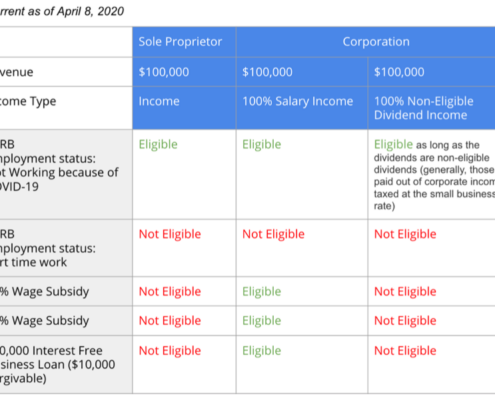

Rules changed to allow more struggling business owners access to CERB, Wage Subsidy. Summer jobs program increased to 100%

Accepting Applications starting April 6th – Canada Emergency Response Benefit (CERB)

Apply for the Canada Emergency Business Account at your bank TODAY!

Do I Qualify for the Canada Emergency Response Benefit & EI?

Help for Small/Medium Businesses & Entrepreneurs – 75% wage subsidy, $40,000 interest-free loan & more